Hey there, fellow Canucks! I'm your go-to expert on passive crypto earning right here in the Great White North, working with the cutting-edge Quantum AI platform. Picture this: you're sipping a double-double from Timmy's, watching the Leafs game (sorry if they're losing again, eh?), and your crypto portfolio is quietly stacking loonies without you lifting a finger. Sounds like a dream? In 2025, it's reality – especially with Quantum AI's AI-driven tools that make passive income as easy as apologizing for no reason. But let's dive deep, with some solid analysis, strategies tailored for Canada, a handy table, and even step-by-step instructions on getting started. We'll keep it fun, throw in some jokes, and highlight our unique selling points (USPs) in the subheads. No hoser moves here – just smart, regulated vibes.

Illustration of crypto staking – your coins working harder than a beaver building a dam!

Our Eh-mazing USP: AI-Powered Predictions for Canadian Crypto Trends in 2025

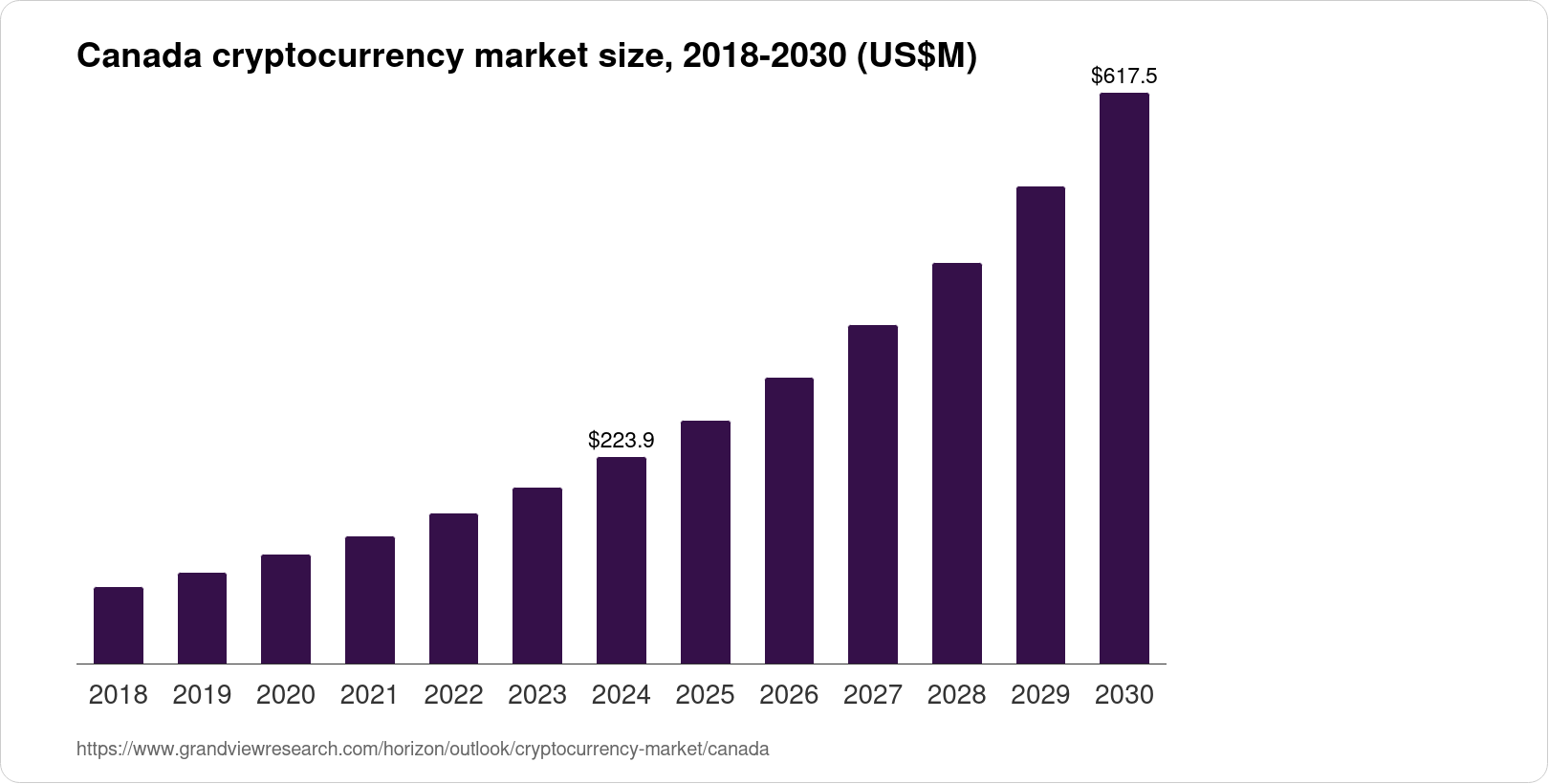

First off, why Quantum AI? Our platform uses quantum computing fused with AI to crunch market data faster than a Zamboni on ice. In 2025, Canada's crypto market is booming – projected to hit $617.5 million by 2030, growing at a CAGR of over 20% from 2018 levels. That's huge, eh? Bitcoin's chart shows wild gains, up 13.85% just in the last month as of October 2025, with peaks over $100K. But passive earning? We're talking staking ETH or SOL for 4-8% APY, yield farming on DeFi for up to 20%, or cloud mining BTC without buying a rig that costs more than a snowmobile.

Deep analysis: The Canadian Securities Administrators (CSA) tightened regs in 2025, making platforms like ours compliant with KYC and anti-money laundering rules. No more Wild West – think safe, like wearing a helmet while snowboarding. Risks? Volatility's a beast; Bitcoin dipped 32% mid-year but bounced back. Taxes? CRA treats passive crypto income as capital gains or business income, so track it or face a penalty bigger than a moose fine. But with Quantum AI's auto-reporting tools, you're golden.

Joke time: Why did the Canadian crypto investor stake his coins? Because he wanted to "eh-rn" while he sleeps!

Canada crypto market growth chart – from loonie to moonie!

Quantum AI's No-Sweat USP: Top Passive Strategies for 2025 in Canada

Here’s the meat and potatoes (or poutine, if you prefer). Passive earning means set-it-and-forget-it: no day trading, just smart setups. Based on 2025 data, here are the best strategies, analyzed for Canadian users:

- Staking: Lock up Proof-of-Stake coins like Ethereum (post-Shanghai upgrade) or Solana. In Canada, use regulated exchanges like Kraken (up to 23% APY on select assets) or Bitbuy. Quantum AI integrates staking pools with AI-optimized rewards – expect 5-10% APY on average. Analysis: Stable earnings, low risk if you HODL through slashes (penalties for downtime). Canada-specific: New Solana ETFs with staking rewards launched in April 2025, adding passive yield to your RRSP.

- Yield Farming/Liquidity Mining: Provide liquidity to DeFi pools on platforms like Aave or Uniswap. Earn fees + tokens. In 2025, APYs hit 10-50% on stablecoin pairs, but watch impermanent loss (like losing your toonie in the snow). Quantum AI's bots auto-rebalance for max yield. Canada perk: Integrate with CAD-stablecoins to avoid forex headaches.

- Crypto Lending: Lend out stablecoins like USDC for interest (4-12% APY). Platforms like Compound or our Quantum AI lending module shine here. Analysis: Safer than farming, but default risks exist – diversify like a true Canuck portfolio.

- Cloud Mining: Rent hash power for BTC without hardware. Top sites like ETNCrypto or DNSBTC offer daily payouts, with ops in Canada for low energy costs. Quantum AI partners for AI-mined passive income, starting with a $100 free trial.

- ETFs and Index Funds: Buy Purpose Bitcoin Yield ETF (BTCY) for BTC exposure + yield. Passive as it gets – trade on TSX, tax-advantaged in TFSA.

Joke: Yield farming in Canada? It's like growing maple syrup – sweet rewards, but you gotta tap the right tree!

For a quick comparison, here's a table of 2025 APYs and risks (based on current market data):

| Strategy | Avg. APY (2025) | Risk Level | Canada-Friendly Platforms | USP on Quantum AI |

|---|---|---|---|---|

| Staking | 5-10% | Low | Kraken, Bitbuy | AI-optimized pools for higher rewards |

| Yield Farming | 10-50% | Medium-High | Aave, Uniswap | Auto-bot farming to minimize losses |

| Lending | 4-12% | Low-Medium | Compound | Instant CAD withdrawals |

| Cloud Mining | 5-15% | Medium | ETNCrypto | Free trial + green energy focus |

| ETFs | 2-8% (with yield) | Low | Purpose BTCY | Integrated tracking in app |

Analytics deep dive: In 2025, staking dominates with $50B+ locked globally, but Canada leads in ETF adoption – over 10% of investors use them for passive income. Volatility index? Crypto's VIX equivalent hovered at 60 mid-year, so diversify: 40% staking, 30% lending, 20% farming, 10% mining. Projected returns? A $10K investment could yield $1-5K annually, pre-tax.

Bitcoin yield farming in action – growing your crypto farm!

Our Beaver-Proof USP: Step-by-Step Registration and Login on Quantum AI

Ready to jump in? Quantum AI is user-friendly – no tech wizardry needed. Here's how:

- Registration: Head to quantum-ai.ca (Canada-optimized site). Click "Sign Up," enter your email, phone, and basic info. Verify with ID (passport or driver's license) for CSA compliance – takes 5 mins, eh? Deposit min $250 CAD via Interac or bank transfer.

- Authorization/Verification: Upload proof of address (utility bill). Our AI scans it instantly. Get approved in 24 hours.

- Login to Personal Cabinet: Use your email/password. Enable 2FA for security – like locking your igloo. Dashboard shows your portfolio, passive setups, and AI insights.

Joke: Registering on Quantum AI is easier than finding a parking spot in Toronto – no circling required!

Quantum AI's Loonie-Loving USP: Withdrawing Crypto in Canada 2025

Cashing out? Seamless. From your cabinet, select "Withdraw," choose CAD to your bank or crypto wallet. Fees? Low 1-2%. Use regulated gateways like Coinsquare for fiat conversion. Taxes: Report to CRA via Form T1135 if holdings >$100K. Pro tip: Withdraw to a TFSA-eligible account for tax-free gains.

In 2025, banks like RBC and TD are crypto-friendly, so transfers zip in 1-3 days. Risks? Market dips during withdrawal – use our AI alerts to time it right.

There you have it, folks – your blueprint for passive crypto riches in Canada 2025. Quantum AI makes it smarter, safer, and more profitable. Questions? Hit me up. Stay frosty out there! 🇨🇦🚀